Technical Indicators for MetaTrader 5

Shopping cart

MetaTrader 5

Top Rated Products MT5

Overview

Rtc ML Ai Predictor — Futuristic Intelligence for Real-Time Market Decisions

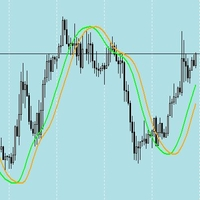

Bring robotic precision to your trading. Rtc ML Ai Predictor fuses Machine Learning with SMA-shift dynamics to forecast short-term momentum and trend inflection points with clarity. The model evaluates multi-factor market structure, assigns a confidence score to each signal, and lets you act only when conditions align with your rules.

Why traders choose Rtc ML Ai Predictor

-

AI-guided entries: ML inference layered with SMA-shift logic for cleaner signals in choppy markets.

-

Confidence-based filtering: Execute only when the model’s confidence meets your threshold—reduce noise, keep the edge.

-

Adaptive behavior: Responds to changing volatility and session profiles to avoid one-size-fits-all signals.

-

Clear visuals: A minimal, modern interface with color-coded states so decisions are instant and repeatable.

-

Low-friction integration: Designed for MetaTrader 5 with lightweight overhead and straightforward parameters.

Key Capabilities

-

Signal Engine: Combines engineered features (price action, moving-average shifts, volatility context) into ML predictions with a 0–100 confidence score.

-

SMA-Shift Filter: Aligns entries with micro-trend bias; helps avoid counter-trend traps.

-

Risk Framework: TP/SL and trailing options compatible; filter by spread/time/session to control execution quality.

-

Symbol Agnostic: Built for major FX, Metals, and Indices; configurable for diverse liquidity conditions.

-

Event Awareness: Optional time filters to sidestep high-impact news windows.

Inputs You Control

-

Risk & Trade Size: Fixed lot or dynamic sizing.

-

Confidence Threshold: Only trade when model confidence ≥ your setting.

-

SMA Period/Shift: Tune sensitivity for trend vs. mean-revert phases.

-

Session & Spread Filters: Gate execution by time and market quality.

-

Take-Profit/Stop-Loss: Set targets that match your risk profile; supports trailing logic.

Recommended Usage

-

Start on a liquid symbol and timeframe you know well.

-

Forward-test with moderate confidence threshold (e.g., 60–70) and conservative risk.

-

Evaluate over multiple sessions (Asia/London/NY) to calibrate filters.

-

Scale gradually once stability is confirmed.

Who it’s for

-

Traders who want AI assistance without losing rule-based control.

-

System builders who value clean signals, robust filters, and MT5 simplicity.

-

Discretionary traders seeking an objective confirmation layer.

Notes & Risk Disclosure

No system guarantees profits. Always test on demo first, size positions responsibly, and adapt to your broker’s execution and costs.