Trading Robots for MetaTrader 5

Shopping cart

MetaTrader 5

Top Rated Products MT5

Overview

Introducing GridWaveGBP – Your Intelligent Grid-Based Trading Assistant

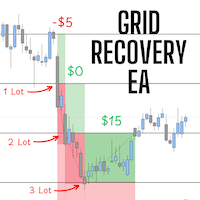

GridWaveGBP is a powerful Expert Advisor designed to detect trading opportunities using a combination of Bollinger Bands, Moving Averages, and the Relative Strength Index (RSI) across multiple timeframes. When a valid signal is detected, instead of opening a single large trade, GridWaveGBP deploys a grid of micro-trades, effectively reducing risk through diversification and low-volume exposure.

Now, 195 USD for 3 buyers

INSTRUMENT SPECIFICATIONS:

- Symbol: GBPUSD

- TimeFrame: Multi-Timeframe Signal Detection

ACCOUNT REQUIREMENTS:

- Type: Hedging

- Spreads: Low Spread

- Min Deposit: $1000

Core Features

-

GridWaveGBP is designed to be used on the GBPUSD.

-

Multi-Timeframe Signal Detection: Trades are initiated based on technical signals detected on various timeframes, allowing for both short-term scalping and long-term trading strategies.

-

Dynamic Trade Management: The EA automatically manages all open positions. It applies trailing stop-losses to secure profits and adjusts them dynamically as profit grows. If a clear reversal signal is detected, the EA will promptly close profitable trades to protect gains.

-

Trade Differentiation by Timeframe:

-

Trades opened based on short-term signals (e.g., M5, M15) are typically managed as scalping trades and closed quickly.

-

Trades based on higher timeframe signals (e.g., H1, H4, D1) are protected with trailing stop-losses and may be held longer to capture broader market moves.

-

Long-Term Strategy with Risk Mitigation

GridWaveGBP is built on the assumption that profitability comes from long-term trading horizons—spanning several months or even years. Loss-making trades are not closed automatically, under the belief that, over time, the market will offer opportunities to close them at break-even or in profit.

However, in the case of strong long-term trends, such as those following the COVID-19 pandemic, losing positions might require manual intervention depending on fundamental and technical market analysis.

Risk is mitigated through the use of micro-lots, ensuring that account balance changes occur at a manageable pace—allowing traders the time for reflection and strategic decision-making.

Key Parameters

-

Start Volume: The fixed lot size used for individual trades.

-

Grid Spacing: The minimum distance (in points) between grid trades.

-

Steps Increase Vol: Gradually increases the trade volume by 0.01 lots every X trades of the same type (default: 999). ⚠️ Warning: Lower values significantly increase risk!

Risk Management & Recommended Settings

The proper selection of parameters relative to your account balance is crucial. Below are test results from the period 2024.12.11 to 2025.01.14, showing the minimum required capital to avoid margin call under specific settings.

Example Setup:

-

Start Volume = 0.01 lots

-

Steps Increase Vol = 999

-

Results for various Grid Spacing values:

| Grid Spacing (points) | Minimum Balance (£) |

| 50 | 1000 |

| 40 | 1350 |

| 30 | 1700 |

| 20 | 2700 |

| 10 | 6000 |

Impact of Steps Increase Vol on Risk

Using this parameter significantly increases risk. It should only be enabled with sufficient account capital.

Below are some examples illustrating the minimum capital resilient to being wiped out during the period from 2024-12-11 to 2025-01-14

(with Start Volume = 0.01 and Grid Spacing = 50):

| Steps Increase Vol | Minimum Balance (£) |

| 20 | 1800 |

| 10 | 2600 |

| 8 | 2900 |

| 6 | 3400 |

| 4 | 5500 |

| 2 | 7700 |

Final Notes

GridWaveGBP is ideal for traders seeking a long-term, low-risk grid trading strategy that adapts to different market conditions. With carefully chosen parameters and disciplined risk management, this EA can become a robust addition to your automated trading toolkit.